The following is a follow up to my March 12, 2020 article. It is NOT a substitute for CDC, New Jersey Department of Health or other governmental directive or guidance. The following is NOT a substitute for a healthcare professional’s advice. We are lawyers who represent Associations. We are NOT public health officials. We are NOT healthcare professionals. We may not be relied upon for public health or healthcare advice.

The following observations are provided merely as one perspective on Coronavirus-related issues in the general Association context. Public health officials and healthcare professionals should be relied upon for public health and healthcare guidance. Questions involving actual facts must be discussed with our attorneys or, in cases where another lawyer represents your Association, with that attorney.

Sources of Information, Recommendations & Updates.

Among other things, the Centers for Disease Control and Prevention (the “CDC”) have noted that: “Older adults and people who have severe underlying chronic medical conditions like heart or lung disease or diabetes seem to be at higher risk for developing more serious complications from COVID-19 illness. Please consult with your health care provider about additional steps you may be able to take to protect yourself”. The CDC website:

https://www.cdc.gov/coronavirus/2019-ncov/ provides information on how the virus spreads, symptoms, steps to prevent illness, what to do if you are sick along with additional information and answers to frequently asked questions “FAQs”. The New Jersey Department of Health provides related information:

https://www.nj.gov/health/cd/topics/ncov.shtml. Go to the CDC’s and the New Jersey Department of Health’s websites regularly for updated information.

A Default Approach?

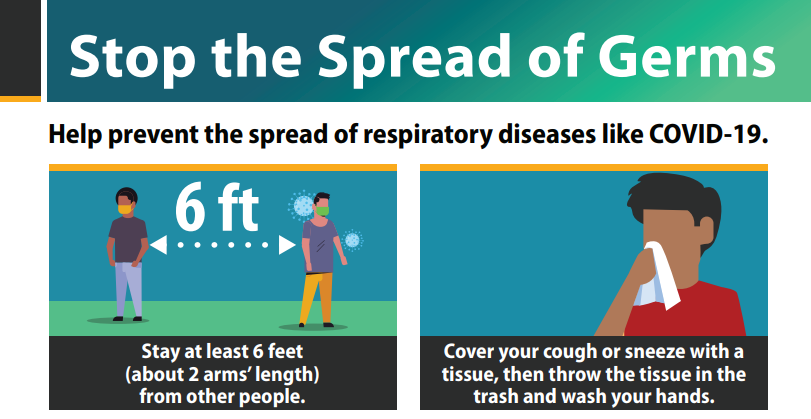

Subject to the above, there is an argument for, to the extent reasonable in the circumstances, Association members conducting themselves in a way that assumes others have been exposed to Coronavirus. Protocols have been based on this approach for years. For example, when healthcare professionals assume that every patient has been exposed to a transmittable disease, safety protocols are followed regardless. Transmission risk is thereby mitigated. Social distancing, among other things, is the order of the day but directions, restrictions and recommendations are changing rapidly. Should five people pile into an elevator? Probably not.

Enhance Cleaning Measures

Cleaning should be enhanced consistent with the CDC’s and the New Jersey Department of Health’s recommendations.

Sick or Exposed People Should Not Go to Work

Association employees/agents/vendors etc. who are sick, have been exposed to the virus or have been in contact with someone who has been exposed to the virus should not go to the Association.

Avoid In-Person Gatherings

The CDC advises that the virus is thought to spread mainly from person-to-person between people who are in close contact with one another. Given this, until the CDC provides information that suggests otherwise, Associations, especially Age Restricted Communities, would be wise to minimize/avoid in-person gatherings.

Board & Membership Meetings May be Held Via Teleconference & Webinar

Board & Membership meetings may be held via teleconference and similar arrangements. These arrangements allow for remote participation by upwards of 1,000 people, far fewer than the typical Association meeting attendance. Association management and counsel should work together to facilitate meetings.

Common Areas Should be Closed & Congregating Discouraged

Regardless of whether the State’s recent directive applies to private facilities, Association Common Element facilities should be closed to the extent that they are inconsistent with the CDC’s and/or the New Jersey Department of Health’s guidance. For example, if they have not already been closed, gyms, kitchens, recreation rooms, etc. (areas that encourage in-person congregating, close personal contact, bodily fluid exposure etc.) should be closed. Fobs, access cards etc. should be disabled and the doors should be locked. In Common Element areas that may remain open such as lobbies, mailboxes, computer centers, hallways, trash rooms etc. congregating should be prohibited, and staggered/timed access may be considered.

Insurance: Notice of Threats/Claims

With respect to threats/claims against the Association, its agents, employees etc., insurance carriers (especially D & O carriers) must be immediately notified of threats/claims so that, if there is a claim, the carrier will not attempt to deny coverage based on a failure to provide timely notice. Of course, insurance carriers may deny claims based on things like the type of insurance, event, claim or policy timing, policy provisions, endorsements, facts of the threats/claims etc. Now though, Associations should be taking reasonable steps to mitigate risks and immediately reporting threats/claims. Coverage debates can be saved for another day.

Open Houses & Move-Ins

Open houses should be suspended and, to the extent possible, move-ins should be rescheduled or scheduled at a time when traffic is at a minimum and maintenance personnel are available for enhanced cleaning to elevators, hallways etc.

Credible Infection & Exposure Reports

Gather, Report, Communicate, Mitigate

This area is fraught with uncertainty. Nevertheless, while proceeding carefully, the Association should take steps to gather information, report information to public officials, communicate to residents (although not the identity of the infected or exposed individual) and mitigate exposure. Infection and exposure reports might be considered credible if they come from the person themselves, public health officials or family members of the affected person. Of course, depending on the facts, other sources may be credible, and the previously stated sources may not.

Should the Association ask residents to notify managers if they have coronavirus or have been exposed? Given the seriousness of the issue, especially if the community is a high rise or is attached housing, the answer is “yes”. Association management may be in a particularly good position to find out this information (although presumably if someone tested positive, the healthcare professional would have already alerted public health officials), advise public health officials, warn the residents and take responsive measures. What if the Association is wrong? Given the circumstances, it is better to err on the side of gathering information, reporting the information to health officials, communicating to residents (although not the identity of the infected or exposed individual) and mitigating to the extent reasonably possible: limit travel areas and contact, clean and disinfect regularly etc.

Panic is Not the Answer

Panic is never the answer, but Association members and managers must keep themselves informed. Reasonable measures will allow Associations to continue to function while mitigating risk and assisting in fighting the virus.

Questions & More Questions

New questions involving actual facts are arising by the minute. Do not hesitate to submit them.

If you have any questions, please contact me.

Thanks,

Fran